In the ever-evolving landscape of finance and technology, a new player has emerged that is capturing the attention of investors and industry experts alike. Puprime, a name that has recently surfaced in financial circles, represents a bold step into the future of decentralized finance (DeFi).

This comprehensive article aims to unravel the mysteries surrounding Puprime, exploring its origins, functionalities, and potential impact on the world of investing.

What is Puprime?

Puprime stands at the intersection of traditional finance and cutting-edge blockchain technology. It is a pioneering platform that seeks to revolutionize the way individuals and institutions interact with financial markets. At its core, Puprime is a decentralized finance solution that leverages the power of blockchain to create a more accessible, transparent, and efficient investment ecosystem.

The Genesis of Puprime

Puprime’s journey began as a response to the growing demand for more innovative and inclusive financial services. Born out of the vision to democratize finance, Puprime aims to break down the barriers that have long restricted access to sophisticated investment opportunities.

The platform’s creators recognized the potential of blockchain technology to address many of the shortcomings of traditional financial systems. By harnessing the power of decentralized networks, Puprime offers a new paradigm for investment management, one that promises greater transparency, reduced costs, and enhanced security.

Key Features of Puprime

Puprime distinguishes itself through a range of innovative features designed to empower investors and streamline the investment process:

- Decentralized Architecture: At the heart of Puprime is its decentralized structure, which eliminates the need for intermediaries and reduces the risk of single points of failure.

- Smart Contract Integration: Puprime utilizes smart contracts to automate and secure transactions, ensuring that agreements are executed precisely as coded.

- Multi-Asset Support: The platform supports a wide range of digital assets, allowing for diverse investment portfolios and strategies.

- Advanced Analytics: Puprime incorporates sophisticated analytical tools to help investors make informed decisions based on real-time market data.

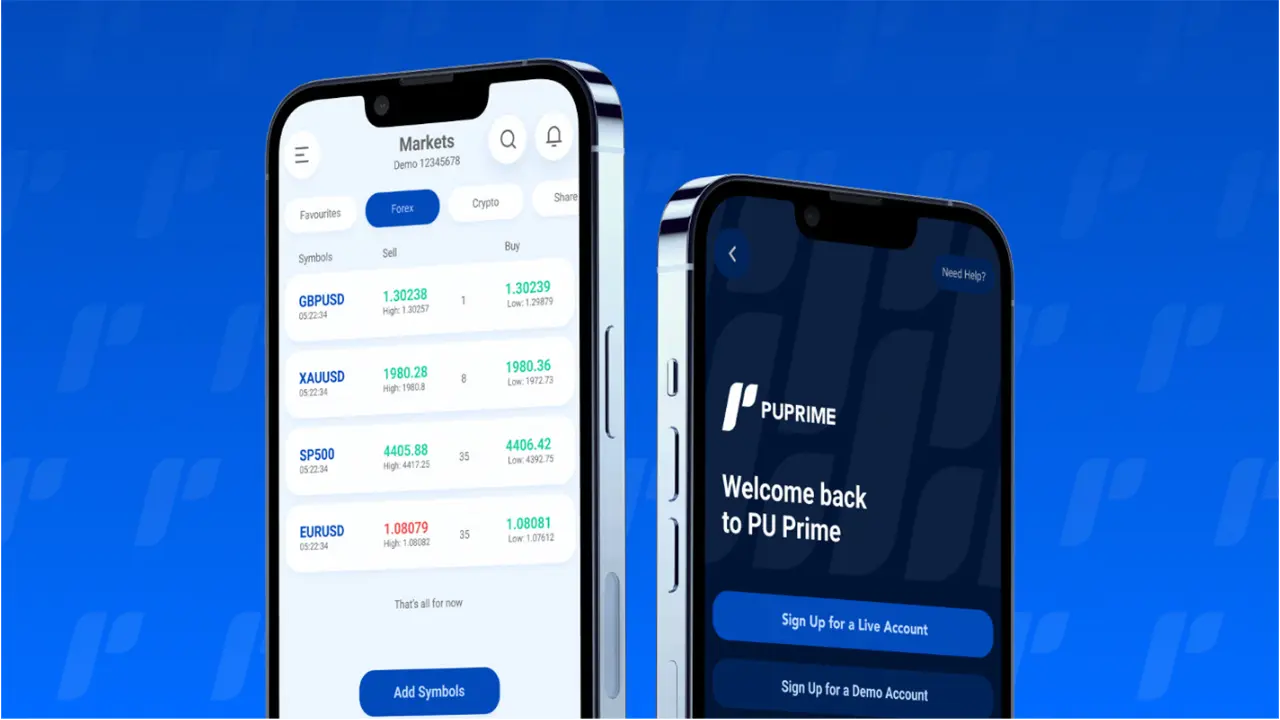

- User-Friendly Interface: Despite its complex underlying technology, Puprime boasts an intuitive interface designed to cater to both novice and experienced investors.

The Technology Behind Puprime

Puprime’s technological foundation is built on blockchain, the same technology that underpins cryptocurrencies like Bitcoin and Ethereum. However, Puprime goes beyond simple cryptocurrency transactions, leveraging blockchain to create a comprehensive financial ecosystem.

The platform utilizes a combination of public and private blockchain networks to balance transparency with the need for data privacy. This hybrid approach allows Puprime to offer the benefits of decentralization while still maintaining the level of security and compliance required in the financial sector.

Furthermore, Puprime incorporates advanced cryptographic techniques to ensure the integrity and confidentiality of user data and transactions. This robust security infrastructure is crucial in building trust among users and regulatory bodies alike.

Puprime’s Vision for the Future of Finance

Puprime’s ambitions extend far beyond being just another investment platform. Its creators envision a future where financial services are more inclusive, efficient, and aligned with the needs of a global, digital-first economy.

By removing intermediaries and automating many aspects of investment management, Puprime aims to reduce costs and increase returns for investors. Moreover, the platform’s 24/7 operation and global accessibility open up new possibilities for cross-border investments and real-time portfolio management.

Puprime also sees itself as a catalyst for financial innovation. By providing a flexible and open platform, it encourages developers and financial experts to create new investment products and services, fostering a vibrant ecosystem of financial creativity.

Understanding Firco

To fully grasp the significance of Puprime, it’s essential to understand its connection to Firco, a key player in the world of financial services and regulatory technology. Firco’s involvement in Puprime adds a layer of credibility and expertise to this innovative platform, bridging the gap between traditional finance and the burgeoning world of decentralized finance (DeFi).

Firco’s Background and Expertise

Firco has long been recognized as a leader in risk management and regulatory compliance solutions for the financial sector. With decades of experience serving banks, insurance companies, and other financial institutions, Firco has built a reputation for delivering robust, reliable technologies that help navigate the complex landscape of global finance.

The company’s core strengths lie in its advanced algorithms for risk assessment, its comprehensive databases of global financial regulations, and its sophisticated software solutions for transaction monitoring and screening. These competencies have positioned Firco as a trusted partner for financial institutions seeking to maintain compliance and manage risk in an increasingly complex regulatory environment.

Firco’s Role in Puprime’s Development

Firco’s involvement in Puprime represents a strategic move into the world of decentralized finance. By leveraging its expertise in risk management and regulatory compliance, Firco aims to bring a level of sophistication and security to Puprime that is often lacking in other DeFi platforms.

The collaboration between Firco and Puprime is multifaceted:

- Risk Management Framework: Firco has contributed its advanced risk assessment methodologies to Puprime, helping to create a robust framework for evaluating and mitigating potential risks associated with decentralized investments.

- Regulatory Compliance: Drawing on its extensive knowledge of global financial regulations, Firco has helped design Puprime’s compliance protocols, ensuring that the platform operates within legal boundaries across various jurisdictions.

- Transaction Monitoring: Firco’s expertise in transaction monitoring has been integrated into Puprime’s infrastructure, enhancing the platform’s ability to detect and prevent fraudulent activities.

- Data Security: Leveraging Firco’s experience in handling sensitive financial data, Puprime has implemented state-of-the-art security measures to protect user information and assets.

The Synergy Between Firco and Puprime

The partnership between Firco and Puprime represents a unique synergy between traditional financial expertise and cutting-edge blockchain technology. This collaboration aims to create a platform that combines the innovation and accessibility of DeFi with the security and regulatory compliance of traditional financial systems.

By bringing together Firco’s proven track record in risk management and regulatory technology with Puprime’s innovative approach to decentralized finance, the partnership seeks to address many of the concerns that have held back wider adoption of DeFi platforms. This includes issues such as regulatory uncertainty, security vulnerabilities, and the lack of sophisticated risk management tools.

Implications for the Future of Finance

The involvement of an established player like Firco in a DeFi project like Puprime signals a significant shift in the financial landscape. It suggests that traditional financial institutions are beginning to recognize the potential of decentralized finance and are seeking ways to integrate these new technologies into their existing frameworks.

This convergence of traditional and decentralized finance could have far-reaching implications:

- Increased Legitimacy for DeFi: The backing of a reputable firm like Firco lends credibility to Puprime and, by extension, to the broader DeFi sector.

- Enhanced Regulatory Compliance: Firco’s expertise could help Puprime navigate the complex regulatory landscape, potentially paving the way for greater regulatory acceptance of DeFi platforms.

- Improved Risk Management: The integration of Firco’s risk management tools could make Puprime more attractive to institutional investors who require robust risk assessment capabilities.

- Bridge Between Traditional and Decentralized Finance: Puprime could serve as a model for how traditional financial institutions can engage with and benefit from decentralized finance technologies.

Exploring Keperkatoen: A Comprehensive Guide

Keperkatoen represents a crucial component of the Puprime ecosystem, serving as a specialized platform for asset management within the broader Puprime framework. Understanding Keperkatoen is key to grasping the full potential of Puprime and its innovative approach to decentralized finance.

What is Keperkatoen?

Keperkatoen is a Dutch term that translates to “cotton twill” in English. In the context of Puprime, it serves as a metaphor for the interwoven nature of various financial assets and strategies. Just as cotton twill is known for its durability and versatility, Keperkatoen aims to provide a robust and flexible platform for managing diverse investment portfolios.

At its core, Keperkatoen is a sophisticated asset management system that operates within the Puprime ecosystem. It leverages blockchain technology and smart contracts to offer a range of features designed to streamline and enhance the investment process.

Key Features of Keperkatoen

Keperkatoen boasts several innovative features that set it apart from traditional asset management platforms:

- Automated Portfolio Rebalancing: Keperkatoen uses advanced algorithms to automatically adjust portfolio allocations based on predefined criteria and market conditions.

- Multi-Asset Support: The platform supports a wide range of digital assets, including cryptocurrencies, tokenized traditional assets, and DeFi tokens.

- Smart Contract-Based Strategies: Investors can create and deploy custom investment strategies using smart contracts, allowing for highly personalized and automated portfolio management.

- Real-Time Analytics: Keperkatoen provides comprehensive, real-time analytics on portfolio performance, market trends, and risk metrics.

- Decentralized Governance: The platform incorporates a decentralized governance model, allowing users to participate in decision-making processes regarding platform upgrades and new features.

How Keperkatoen Works

Keperkatoen operates on a decentralized network, leveraging blockchain technology to ensure transparency, security, and efficiency. Here’s a step-by-step breakdown of how it functions:

- Asset Onboarding: Users can onboard various digital assets onto the Keperkatoen platform. These assets are tokenized if they aren’t already in a digital format.

- Strategy Creation: Investors can create custom investment strategies using Keperkatoen’s intuitive interface. These strategies can range from simple allocations to complex, multi-factor models.

- Smart Contract Deployment: Once a strategy is created, it is encoded into a smart contract and deployed on the blockchain.

- Automated Execution: The smart contract automatically executes trades and rebalances the portfolio based on the predefined strategy and market conditions.

- Performance Monitoring: Users can monitor the performance of their strategies in real-time through Keperkatoen’s analytics dashboard.

- Strategy Adjustment: Investors can adjust their strategies as needed, with changes being reflected in the underlying smart contracts.

The Role of Keperkatoen in Puprime’s Ecosystem

Keperkatoen plays a crucial role in Puprime’s broader ecosystem, serving as the engine that powers much of the platform’s asset management capabilities. Its integration with other Puprime components creates a seamless experience for users, from onboarding assets to executing complex investment strategies.

Moreover, Keperkatoen’s decentralized nature aligns perfectly with Puprime’s vision of democratizing finance. By providing sophisticated asset management tools in a decentralized, accessible format, Keperkatoen helps level the playing field between individual investors and large institutions.

The Future of Asset Management with Keperkatoen

As Keperkatoen continues to evolve, it has the potential to revolutionize the way we think about asset management. Some potential future developments include:

- Integration with AI and Machine Learning: Incorporating advanced AI algorithms could enhance Keperkatoen’s predictive capabilities and strategy optimization.

- Expansion to Traditional Assets: While currently focused on digital assets, Keperkatoen could potentially expand to include a wider range of traditional financial instruments.

- Enhanced Interoperability: Future upgrades could improve Keperkatoen’s ability to interact with other DeFi platforms and traditional financial systems.

- Regulatory Compliance Features: As the regulatory landscape for DeFi evolves, Keperkatoen may incorporate additional features to ensure compliance across various jurisdictions.

Pteridine: Structure, Function, and Significance

In the context of Puprime, pteridine serves as a fascinating metaphor for the complex and interconnected nature of the platform’s underlying technology. Just as pteridine compounds play crucial roles in various biological processes, the intricate structures within Puprime work together to create a robust and efficient financial ecosystem.

Understanding Pteridine

Pteridine is a class of organic compounds characterized by a specific ring structure consisting of fused pyrimidine and pyrazine rings. These compounds are widely distributed in nature and play essential roles in various biological processes. The study of pteridines has significant implications in fields ranging from biochemistry to medicine.

The Structure of Pteridine

The basic structure of pteridine consists of two nitrogen-containing rings:

- Pyrimidine Ring: A six-membered ring containing two nitrogen atoms.

- Pyrazine Ring: Another six-membered ring with two nitrogen atoms, fused to the pyrimidine ring.

This unique structure gives pteridines their distinctive properties and functions. In the context of Puprime, this structure can be seen as analogous to the platform’s foundational elements, with each component playing a crucial role in the overall functionality.

Functions of Pteridine in Biological Systems

Pteridines serve various essential functions in biological systems:

- Cofactors: Some pteridines act as cofactors for enzymes, facilitating important biochemical reactions.

- Pigmentation: Certain pteridine derivatives contribute to the coloration of organisms, such as the bright colors of butterfly wings.

- Redox Reactions: Pteridines can participate in redox reactions, playing a role in cellular energy metabolism.

- Signal Transduction: Some pteridine compounds are involved in cellular signaling pathways.

- Immune Function: Certain pteridines play a role in immune system regulation.

The Metaphorical Significance of Pteridine in Puprime

The complex structure and diverse functions of pteridine serve as an apt metaphor for the intricate workings of Puprime:

- Interconnectedness: Just as the fused rings of pteridine work together to create a functional molecule, the various components of Puprime are interconnected to create a cohesive financial platform.

- Multifunctionality: Like pteridines that serve multiple roles in biological systems, Puprime is designed to offer a range of financial services and functions within a single ecosystem.

- Adaptability: The diverse roles of pteridines in nature mirror Puprime’s ability to adapt to various financial needs and market conditions.

- Foundational Importance: Just as pteridines are fundamental to many biological processes, the underlying structure of Puprime is crucial to its functionality and efficiency.

- Complexity and Elegance: The intricate structure of pteridine, while complex, results in elegant and efficient molecules. Similarly, Puprime’s sophisticated technology is designed to provide an elegant solution to complex financial challenges.

Pteridine-Inspired Innovation in Puprime

Drawing inspiration from the structure and function of pteridines, Puprime incorporates several innovative features:

- Modular Design: Like the modular nature of pteridine’s ring structure, Puprime is built with a modular architecture that allows for easy upgrades and additions of new features.

- Multifaceted Functionality: Inspired by the diverse roles of pteridines, Puprime offers a wide range of financial services within a single platform.

- Efficient Energy Usage: Taking cues from pteridines’ role in cellular energy processes, Puprime is designed to operate with high energy efficiency, particularly in its blockchain operations.

- Adaptive Algorithms: Drawing parallels with pteridines’ involvement in cellular signaling, Puprime employs adaptive algorithms that respond to market signals and user behavior.

- Robust Security Measures: Inspired by the stability of pteridine structures, Puprime implements robust security measures to protect user assets and data.

Future Implications of the Pteridine Metaphor

As our understanding of pteridines in biological systems continues to grow, it may inspire further innovations in the design and functionality of platforms like Puprime:

- Biomimetic Algorithms: Future versions of Puprime might incorporate algorithms inspired by the way pteridines function in biological systems, potentially leading to more efficient and adaptive financial processes.

- Enhanced Interconnectivity: Inspired by the interconnected nature of biological systems involving pteridines, Puprime may develop enhanced features for interoperability with other financial platforms and systems.

- Novel Security Approaches: The study of pteridines’ role in immune function could inspire new approaches to cybersecurity within the Puprime ecosystem.

- Sustainable Design: Drawing on the energy efficiency of biological processes involving pteridines, future iterations of Puprime may focus on even greater sustainability and energy efficiency.

200 kPa: Pressure Explained

In the context of Puprime, the concept of 200 kPa serves as a powerful metaphor for the platform’s operational efficiency and its ability to handle the pressures of the financial market. Understanding this analogy requires a deeper look into the nature of pressure and its implications in both physical and financial systems.

Understanding Pressure

Pressure is a fundamental concept in physics, defined as the force applied perpendicular to the surface of an object per unit area. In the International System of Units (SI), pressure is measured in pascals (Pa), with 1 Pa equal to 1 Newton of force applied over 1 square meter.

The unit kPa, or kilopascal, is equivalent to 1000 pascals. Therefore, 200 kPa represents a significant amount of pressure – approximately twice the standard atmospheric pressure at sea level.

The Significance of 200 kPa

In various industrial and engineering applications, 200 kPa is a noteworthy pressure level:

- Hydraulic Systems: Many hydraulic systems operate at pressures around 200 kPa, allowing for efficient power transmission.

- Pneumatic Tools: Some pneumatic tools function optimally at pressures near 200 kPa.

- Process Industries: In chemical and process industries, 200 kPa might represent a critical pressure point for certain operations or safety measures.

4.Medical Applications: In medical settings, 200 kPa could be relevant for monitoring blood pressure or regulating certain medical devices.

The Metaphorical Interpretation in Puprime

In the context of Puprime, the concept of 200 kPa can be metaphorically linked to the platform’s operational environment:

- Operational Efficiency: Just as systems in engineering and industry thrive under 200 kPa, Puprime is designed to operate efficiently even under significant market pressures.

- Power and Performance: Similar to hydraulic systems utilizing 200 kPa for power transmission, Puprime leverages its capabilities to deliver robust performance and financial services.

- Critical Thresholds: In the financial landscape, reaching or surpassing the metaphorical 200 kPa may signify pivotal moments or challenges that Puprime successfully navigates.

- Stability and Reliability: Like how certain tools excel at 200 kPa, Puprime aims to maintain stability and reliability for its users amidst dynamic market conditions.

Puprime’s Response to Pressure

Understanding the metaphorical significance of 200 kPa in relation to Puprime sheds light on the platform’s approach to handling pressures:

- Adaptive Strategies: Puprime employs adaptive strategies to respond to changing market pressures and user demands effectively.

- Resilience and Durability: Similar to structures engineered to withstand 200 kPa, Puprime is built with resilience and durability to ensure continued operation and service provision.

- Precision and Accuracy: Operating at metaphorical 200 kPa requires precision, which reflects Puprime’s commitment to accurate financial transactions and data management.

- Innovation Under Pressure: Just as industries innovate to meet the challenges of 200 kPa environments, Puprime fosters innovation to stay ahead in the competitive financial sector.

Future Challenges and Opportunities

As Puprime continues to evolve and adapt to the ever-changing financial landscape, the concept of 200 kPa can serve as a guiding principle for addressing future challenges and opportunities:

- Scalability: Maintaining operational efficiency akin to operating at 200 kPa will be crucial as Puprime scales its services and user base.

- Risk Management: Understanding and managing risks equivalent to 200 kPa scenarios will be essential for ensuring the platform’s stability and security.

- Innovation Drive: Embracing the metaphorical pressure of 200 kPa can fuel Puprime’s drive for innovation, leading to new features and services that set it apart in the market.

- Market Resilience: By embodying the resilience associated with 200 kPa environments, Puprime can navigate market fluctuations and uncertainties with confidence.

Cichorium Intybus (Chicory): Botanical Insights

Cichorium intybus, commonly known as chicory, is a plant with diverse culinary, medicinal, and agricultural uses. Exploring the botanical insights of chicory not only provides a deeper understanding of this versatile plant but also offers valuable lessons and parallels for platforms like Puprime in terms of adaptability, versatility, and sustainability.

Botanical Characteristics of Chicory

- Growth Habit: Chicory is a perennial herbaceous plant that can grow up to several feet in height, with bright blue flowers clustered along its stems.

- Root Structure: The taproot of chicory is long and sturdy, allowing the plant to access nutrients deep within the soil.

- Leaf Composition: Chicory leaves are deeply lobed and often used in salads for their slightly bitter flavor profile.

- Flowering and Seed Production: Chicory produces vibrant blue flowers that attract pollinators and eventually develop into seeds for reproduction.

Culinary and Medicinal Uses

- Culinary Applications: Chicory leaves are commonly used in salads, while the roasted and ground roots can be brewed as a coffee substitute or additive.

- Medicinal Properties: Traditionally, chicory has been used in herbal medicine for its potential digestive and anti-inflammatory benefits.

- Agricultural Importance: Chicory is also utilized in agriculture as a forage crop for livestock due to its nutritional value and hardiness.

Lessons from Chicory for Puprime

- Adaptability: Similar to chicory’s ability to thrive in various environments, Puprime must adapt to changing market conditions and user needs to remain successful.

- Versatility: Just as chicory serves multiple purposes across culinary, medicinal, and agricultural domains, Puprime can explore diverse financial services to cater to a broad user base.

- Sustainability: The robust root structure of chicory hints at sustainability and longevity, qualities that Puprime should prioritize in its operations and growth strategies.

- Nutrient-Rich Growth: Like chicory accessing nutrients deep within the soil, Puprime can benefit from tapping into diverse financial resources and markets for sustained growth.

Cultivating Success like Chicory

By drawing inspiration from the botanical insights of chicory, Puprime can cultivate success in the following ways:

- Rooted in Strength: Establishing a strong foundation and infrastructure is key for Puprime to weather challenges and foster growth.

- Blossoming Opportunities: Similar to chicory’s flowering stage, Puprime can seize opportunities for expansion and innovation within the financial sector.

- Bitter-Sweet Balance: Embracing the slightly bitter aspects of competition and setbacks can lead to valuable lessons and strategic improvements for Puprime.

- Pollinating Partnerships: Collaborating with partners and stakeholders can help Puprime cross-pollinate ideas and strategies for mutual benefit and growth.

Nurturing Resilience and Growth

As Puprime navigates the complexities of the financial world, the botanical insights from chicory underscore the importance of resilience, adaptability, and sustainable growth:

- Deep Roots of Stability: Building a foundation rooted in stability and security will fortify Puprime against market fluctuations and uncertainties.

- Flowering Innovation: Encouraging a culture of innovation and creativity can lead to the blossoming of new ideas and solutions within Puprime.

- Harvesting Success: By leveraging its strengths and embracing lessons from challenges, Puprime can harvest success and establish itself as a prominent player in the financial industry.

- Sowing Seeds of Collaboration: Cultivating partnerships and collaborations, much like chicory’s seed production, can sow the seeds of growth and expansion for Puprime in the future.

Puprime Review: A Critical Assessment

As a comprehensive investment platform, Puprime has garnered attention for its innovative features, user-friendly interface, and diverse financial services. However, a critical assessment of Puprime is essential to evaluate its strengths, weaknesses, opportunities, and threats in the competitive landscape of investment platforms.

User Experience and Interface Design

- Intuitive Navigation: Puprime’s user interface is praised for its intuitive design, making it easy for both novice and experienced investors to navigate the platform.

- Accessibility and Mobile Responsiveness: The accessibility of Puprime across various devices, including mobile phones and tablets, enhances user convenience and engagement.

- Customization Options: Users appreciate the customization features on Puprime that allow them to personalize their investment portfolios according to their preferences and risk tolerance.

Investment Offerings and Diversification

- Asset Variety: Puprime offers a wide range of investment options, including stocks, bonds, cryptocurrencies, and commodities, enabling users to diversify their portfolios effectively.

- Risk Management Tools: The inclusion of risk management tools on Puprime provides users with insights and strategies to mitigate potential investment risks and optimize returns.

- Investment Performance: Analyzing the historical performance of investments on Puprime can offer valuable insights into the platform’s effectiveness in generating returns for users.

Security and Compliance Measures

- Data Encryption: Puprime’s use of advanced encryption technologies to secure user data and transactions instills trust and confidence among investors regarding data privacy and security.

- Regulatory Compliance: Adhering to regulatory standards and compliance requirements is crucial for Puprime to maintain transparency and legality in its operations.

- Fraud Prevention: Implementing robust fraud prevention measures, such as identity verification protocols and transaction monitoring, is essential for safeguarding user assets on Puprime.

Customer Support and Community Engagement

- Responsive Support Team: The responsiveness and effectiveness of Puprime’s customer support team in addressing user inquiries and concerns contribute to overall user satisfaction.

- Educational Resources: Providing educational resources and materials on investment strategies and financial literacy enhances user knowledge and empowerment on Puprime.

- Community Forums and Events: Engaging users through community forums, webinars, and events fosters a sense of belonging and collaboration among Puprime investors.

SWOT Analysis of Puprime

- Strengths:

- Innovative technological features

- Diverse investment options

- Strong security measures

- Weaknesses:

- Limited availability in certain regions

- Complexity for beginner investors

- Potential scalability challenges

- Opportunities:

- Expansion into new markets

- Integration of emerging technologies

- Partnerships with financial institutions

- Threats:

- Regulatory changes impacting operations

- Cybersecurity risks and data breaches

- Competition from established investment platforms

Recommendations for Puprime

- Enhance Educational Resources: Expanding educational materials and resources can empower users to make informed investment decisions and improve overall engagement.

- Geographic Expansion: Considering expansion into untapped markets can broaden Puprime’s user base and increase global visibility and accessibility.

- Continuous Innovation: Investing in research and development to introduce new features and technologies can keep Puprime at the forefront of the evolving investment landscape.

- Strategic Partnerships: Collaborating with financial institutions or fintech companies can open doors to new opportunities and enhance the range of services offered on Puprime.

Is Puprime Regulated? Examining Regulatory Compliance

Regulatory compliance is a critical aspect of any financial platform, ensuring transparency, security, and legal adherence in all operations. As an investment platform, Puprime’s regulatory status and compliance measures play a significant role in building trust with users and authorities alike. Examining Puprime’s regulatory framework provides insights into its commitment to upholding industry standards and protecting investor interests.

Regulatory Bodies and Oversight

- Financial Conduct Authority (FCA): In the UK, the FCA regulates financial firms and markets, setting standards for conduct and consumer protection.

- Securities and Exchange Commission (SEC): In the US, the SEC oversees securities markets and enforces regulations to protect investors and maintain fair, orderly, and efficient markets.

- European Securities and Markets Authority (ESMA): ESMA works to enhance investor protection and promote stable and orderly financial markets across the EU member states.

Puprime’s Compliance Measures

- KYC and AML Procedures: Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures are integral to Puprime’s compliance efforts, verifying user identities and preventing illicit activities.

- Data Protection: Puprime adheres to data protection regulations such as the General Data Protection Regulation (GDPR) to safeguard user information and privacy rights.

- Licensing and Registration: Puprime obtains necessary licenses and registrations from regulatory authorities to operate legally and ethically within jurisdictions.

Transparency and Disclosure Practices

- Financial Reporting: Puprime maintains transparent financial reporting practices, providing users with access to detailed information on investment performance and fees.

- Risk Disclosures: Clear and comprehensive risk disclosures on Puprime’s platform inform users about potential investment risks and market uncertainties.

- Terms of Service: Transparent terms of service outline user rights, responsibilities, and the platform’s obligations, fostering trust and accountability.

Regulatory Challenges and Compliance Risks

- Evolving Regulations: Keeping pace with changing regulatory landscapes globally poses challenges for Puprime in ensuring ongoing compliance and adaptation.

- Cross-Border Operations: Operating in multiple jurisdictions requires Puprime to navigate diverse regulatory frameworks and international compliance standards.

- Enforcement Actions: Non-compliance with regulatory requirements can result in enforcement actions, fines, reputational damage, and legal consequences for Puprime.

Regulatory Compliance Best Practices

- Proactive Monitoring: Regularly monitoring regulatory developments and updates enables Puprime to proactively adjust policies and procedures to remain compliant.

- Staff Training: Providing comprehensive training to employees on regulatory requirements and compliance protocols fosters a culture of adherence and awareness within Puprime.

- External Audits: Conducting regular external audits and assessments of compliance measures ensures alignment with regulatory standards and identifies areas for improvement.

Regulatory compliance is a cornerstone of Puprime’s operations, reflecting its commitment to integrity, security, and user protection. By upholding stringent compliance measures, engaging with regulatory bodies, and prioritizing transparency and accountability, Puprime can build trust, mitigate risks, and foster sustainable growth in the competitive landscape of investment platforms. Continual vigilance, adaptation, and collaboration with regulatory authorities will be key for Puprime to navigate regulatory challenges and maintain its position as a trusted and compliant financial platform.